Medicare Part D: A First Look at Prescription Drug Plans in 2019

During the Medicare open enrollment period from October 15 to December 7 each year, beneficiaries can enroll in a plan that provides Part D drug coverage, either a stand-alone prescription drug plan (PDP) as a supplement to traditional Medicare, or a Medicare Advantage prescription drug plan (MA-PD), which covers all Medicare benefits, including drugs. This issue brief provides an overview of the 2019 PDP landscape, the largest segment of the Medicare Part D marketplace, with 20.6 million enrollees in 2018.

Key Findings

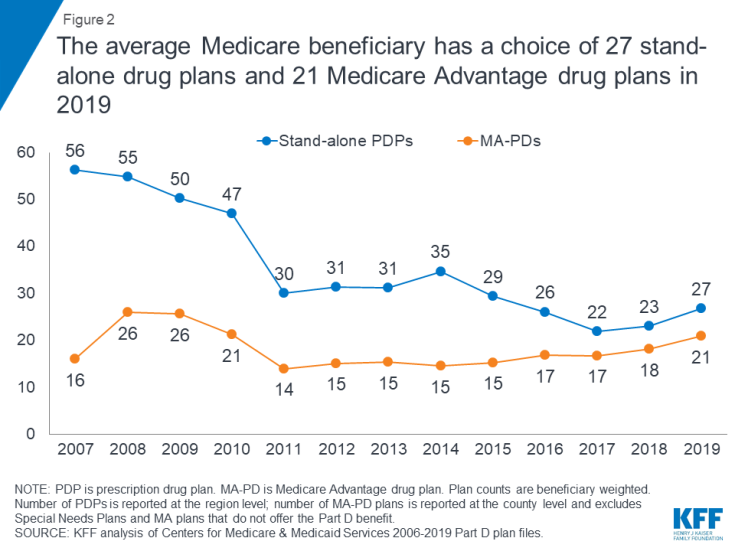

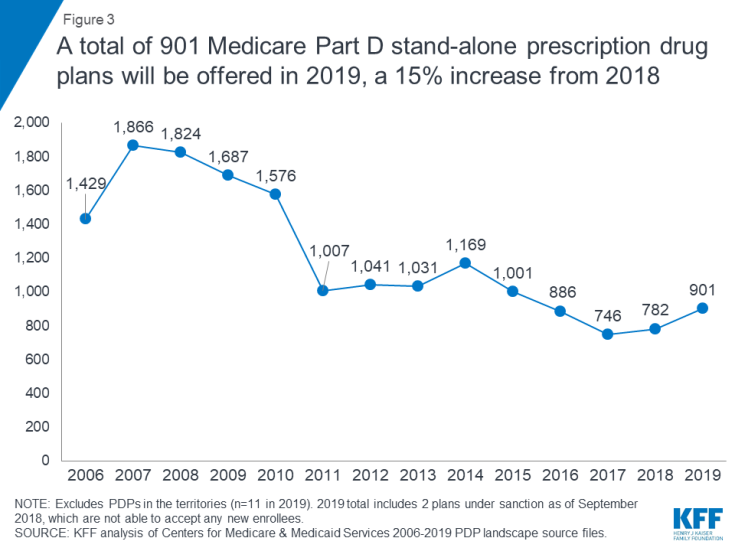

- For 2019, Medicare beneficiaries will have more Part D plan choices than in 2018, including 27 stand-alone PDPs and 21 MA-PDs in their area, on average (excluding MA plans that do not include the drug benefit). A total of 901 PDPs will be offered in the 34 PDP regions in 2019 (plus another 11 PDPs in the territories). This represents an increase of 119 PDPs, or 15 percent, over 2018, and the second year in a row with an increase, after three years of plan reductions.

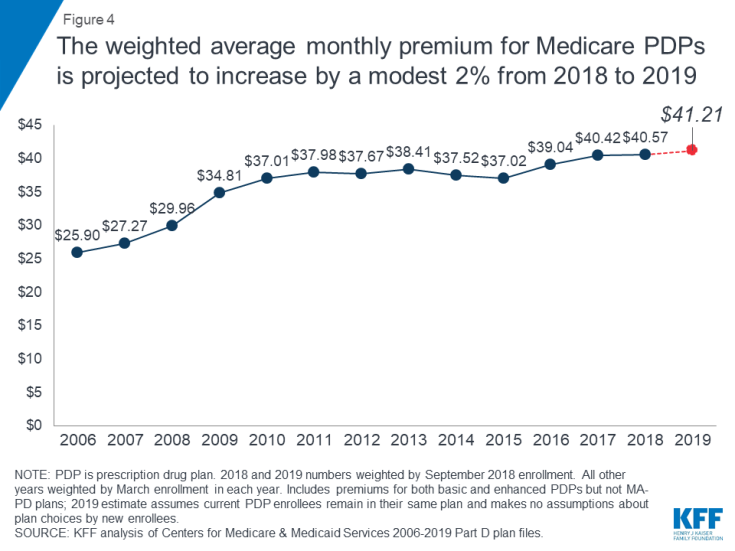

- The average monthly PDP premium will increase by a modest 2 percent between 2018 and 2019, to $41.21, weighted by September 2018 enrollment. This estimate, which includes premiums for both basic and enhanced PDPs, is weighted based on current enrollment, assumes current enrollees do not switch, and makes no assumptions about plan choices by new enrollees or reassignment of low-income beneficiaries.

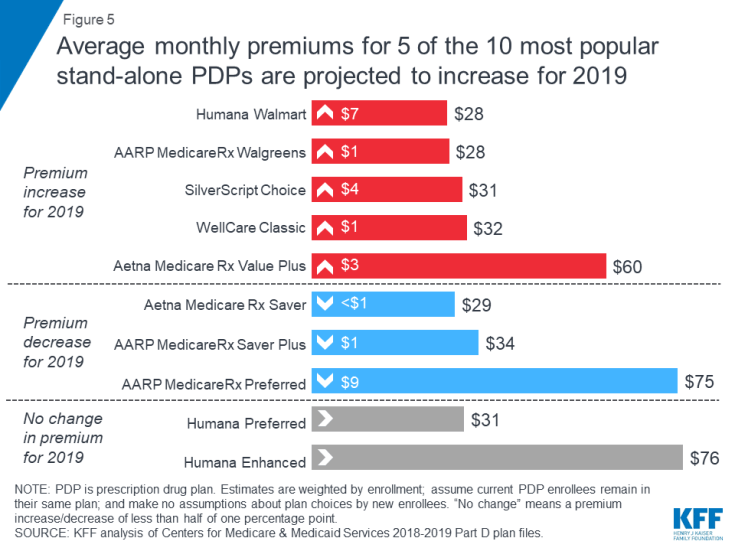

- For 2019, PDP premiums will vary widely across plans, as in previous years. Among the 10 PDPs with the most enrollees, average premiums will range from a low of $28 per month ($332 per year) for Humana Walmart to a high of $76 per month ($911 per year) for Humana Enhanced (Figure 1).

- Most Part D enrollees will face modest cost-sharing amounts for generic drugs in 2019 but much higher cost sharing for brands and non-preferred drugs, and a mix of copayments and coinsurance for different formulary tiers. Among the 10 largest PDPs, copayments range from $0 to $5 for preferred generics; $1 to $13 for generics; $25 to $47 for preferred brands; 32% to 50% coinsurance for non-preferred drugs (the maximum allowed for this tier); and 25% to 33% for specialty drugs.

- Medicare beneficiaries receiving the Low-Income Subsidy (LIS) will have a choice of six premium-free PDPs in 2019, on average, the same as in 2018. In 2019, nearly one million low-income beneficiaries who are eligible for premium-free Part D coverage will pay Part D premiums averaging nearly $28 per month ($333 per year), unless they switch or are reassigned by CMS to premium-free plans.

Findings

Part D Plan Availability

A larger number of Part D plans will be offered in 2019 than in recent years.

- The average beneficiary will have a choice of 27 PDPs in 2019, up from 23 in 2018, but well below the peak of 56 PDPs in 2007 (Figure 2). In 2019, beneficiaries will also have access to 21 MA-PDs, on average, up from 18 in 2018 (excluding MA plans that do not offer the drug benefit).

- A total of 901 PDPs will be offered in the 34 PDP regions in 2019 (plus another 11 PDPs in the territories). This represents an increase of 119 PDPs, or 15 percent, over 2018, and the second year in a row with an increase, after three years of plan reductions (Figure 3).

This increase is likely due to the elimination of the “meaningful difference” requirement for enhanced benefit PDPs offered by the same organization in the same region. Eliminating this requirement means that PDP sponsors no longer have to demonstrate that their enhanced PDPs offered in the same region are meaningfully different in terms of enrollee out-of-pocket costs. In 2019, 61% of PDPs (553 plans) will offer enhanced Part D benefits—an increase from 2018 when 54% of PDPs (421 plans) offered enhanced benefits.

- The number of PDPs per region in 2019 will range from 22 PDPs in Alaska to 30 PDPs in the Pennsylvania/West Virginia region and California, and will be higher in each of the 34 PDP regions compared to 2018 (see map; Table 1).

–

Premiums

National Premium Trends

The national average monthly PDP premium is expected to increase for the fourth year in a row, but only modestly for 2019.

- The projected average monthly PDP premium for 2019 will be $41.21 (Figure 4). The 2019 premium represents a modest 2 percent projected increase ($0.64) from the weighted average monthly premium of $40.57 in 2018. Since 2006, the first year of the Medicare Part D drug benefit, the weighted average monthly premium for PDPs has increased by 59 percent.

- Among the 13.0 millionPart D PDP enrollees who are responsible for paying the entire premium (which excludes Low-Income Subsidy (LIS) recipients), many enrollees pay premiums that are well above the national average. In 2019, three in 10 PDP enrollees not receiving the LIS are projected to pay monthly premiums of at least $60 if they stay in their current plans, and more than 280,000 (2 percent of non-LIS enrollees) are projected to pay monthly premiums of at least $100.

- CMS reported that the average premium for basic Part D coverage offered by PDPs and MA-PDs will be an estimated $32.50 in 2019. Our premium estimate is higher because it is based on PDPs only and includes PDPs offering both basic and enhanced coverage (enhanced plans have higher premiums than basic plans, on average). In addition, our premium estimates are weighted based on current enrollment and do not incorporate any assumptions about plan changes by current enrollees, reassignment of Low-Income Subsidy (LIS) enrollees by CMS, or plan choices by new enrollees.

- In prior years, the average premium that we have calculated after taking into account enrollment changes made during the open enrollment period has been somewhat lower than our projection based on current enrollment. For example, the weighted average premium calculated in March 2018, after the open enrollment period ended, was $41.24, 5 percent ($2.24) below the projected premium of $43.48 calculated prior to enrollment changes. The reduction is due to current enrollees switching to lower premium plans, new enrollees choosing low-premium plans, and reassignments of some LIS beneficiaries to lower-premium plans.

Premium Variation and Changes for PDPs with the Most Enrollees

PDP premiums will continue to vary widely across plans in 2019, as in previous years.

- Among the 10 PDPs with the highest enrollment, average PDP premiums in 2019 will range from a low of $28 per month ($332 per year) for Humana Walmart Rx to $76 per month ($911 per year) for Humana Enhanced (Figure 1; Table 2).

Changes to premiums from 2018 to 2019, averaged across regions and weighted by September 2018 enrollment, also vary widely across some of the most popular PDPs, as do the absolute amounts of monthly premiums for 2019.

- Among the 10 largest PDPs, average monthly premiums for 2019 are projected to increase for five plans, decrease for three plans, and remain stable for two plans, based on current enrollment (Figure 5).

- The 4.6 million enrollees in SilverScript Choice, the PDP with the most enrollees in 2018, will see a 17 percent increase in their monthly premium for 2019 if they stay in this plan, from $26 to $31, on average. The 2.4 million enrollees in the third largest PDP, Humana Walmart Rx, will face an even larger 37 percent increase in their monthly premium, from $20 to $28, on average—but this is still the lowest premium plan among the top 10 PDPs.

- In contrast, the 2.5 million enrollees in the second largest PDP, UnitedHealth’s AARP MedicareRx Preferred, will face an 11 percent decrease in the average monthly premium, from $84 to $75. Of the 10 most popular PDPs, this is the largest average premium reduction for 2019—but still the second highest monthly premium for 2019 among the top 10 PDPs. The highest premium among the top PDPs is for Humana Enhanced, with 0.8 million enrollees, at $76 per month in 2019.

Premium Variation by Region

Average PDP monthly premiums for 2019 will vary across the 34 PDP regions.

- Average PDP premiums will range from $34 per month in Hawaii to $46 per month in California, New Jersey, and New York (see map; Table 1).

- All 34 PDP regions have at least one PDP with a premium under $20. For example, the Aetna Medicare Rx Select PDP is available in all regions with monthly premiums ranging from $12.20 to $19.20, while the EnvisionRxPlus PDP is available in 13 regions with monthly premiums ranging from $12.90 to $16.50 (but in another 21 regions for premiums ranging from $24.80 to $66.70). At the high end, 6 PDPs, with a total of 86,000 enrollees in 2018 (less than 1% of total PDP enrollment), have monthly premiums of at least $125. The highest is $156 for Blue Rx PDP Complete, which is offered in the Pennsylvania/West Virginia region.

- Average premiums are projected to be modestly higher in 13 regions, increasing by between $1 and $4. In 2 regions, average premiums will decrease by between $1 and $2, and in 19 regions average premiums will be within $1 of their 2018 average.

Benefit Design and Cost Sharing

In 2019, all PDPs will offer an alternative benefit design, different from the defined standard benefit, which has a $415 deductible (an increase from $405 in 2018) and 25 percent coinsurance for all covered drugs between the deductible and the initial coverage limit. Part D plans must offer either the defined standard benefit or an alternative equal in value (“actuarially equivalent”), which is the basic Part D benefit, and can also provide enhanced benefits. Plans with enhanced benefits can have a lower (or no) deductible, reduced cost sharing, and/or a higher initial coverage limit than under the standard benefit design.

In 2019, virtually all PDPs will have a benefit design with five tiers for covered generic and brand-name drugs and cost sharing other than the standard 25 percent. As of 2019, Part D enrollees will no longer be exposed to a coverage gap, sometimes called the “donut hole”, when they fill their brand-name medications. Under changes made by the Bipartisan Budget Act of 2018, Part D enrollees’ out-of-pocket costs for brand-name drugs between the initial coverage limit and the catastrophic coverage threshold (the coverage gap phase) will decline from 35 percent of total costs in 2018 to 25 percent in 2019—rather than in 2020—while plans’ share of costs for brands will decrease to 5 percent and the manufacturer discount will increase from 50 percent to 70 percent. Enrollees will pay 37 percent of the cost for generic drugs in the gap and plans will pay 63 percent.

Basic versus Enhanced Benefits

- In 2019, 61 percent of plans will offer enhanced benefits, an increase over 2018 when 53 percent offered enhanced benefits (Table 3). As noted earlier, this increase is likely a response by Part D plan sponsors to the elimination of the requirement to demonstrate a “meaningful difference” (measured by enrollee out-of-pocket costs) between enhanced plans offered by the same firm in the same region. A smaller share of plans (39%) will offer basic Part D benefits in 2019 (compared to 47 percent in 2018), and as in recent years, no plans will offer the defined standard benefit.

- The weighted average premium in 2019 for enhanced benefit PDPs ($54) is 67 percent higher than the monthly premium for PDPs offering the basic benefit ($32).

Deductibles

- A larger share of PDPs will charge a deductible in 2019 than in 2018 (71% vs. 63%), with the increase due to a larger share of plans charging a deductible lower than the standard amount (Table 3). More than half of PDPs will charge the standard $415 deductible in 2019 (52%).

- The weighted average premium in 2019 for PDPs that charge no deductible ($54) is around $20 per month higher than the monthly premium for PDPs that charge the standard deductible ($32) or a partial deductible ($33).

Cost Sharing

- As in recent years, all PDPs in 2019 will use tiered cost sharing. The typical five-tier design includes tiers for preferred generics, generics, preferred brands, non-preferred drugs (which includes both brands and generics), and specialty drugs. Five-tier formularies have been the most common type since 2013.

- Overall, PDP cost-sharing amounts in 2019 are relatively similar to 2018 levels (Table 4). For generic tiers, median copayments across PDPs are $1 for the preferred generic tier and $5 for the generic tier.

- Three of the 10 largest PDPs (AARP MedicareRx Walgreens, Humana Preferred, and WellCare Classic) have a $0 copayment for preferred generic drugs in 2019. Median copayments for generics range from $1 to $13 among the 10 largest PDPs.

- Most PDPs charge copayments for preferred brand tiers, but nearly one-fourth of PDPs in 2019 (23 percent) charge coinsurance. For preferred brand tiers, the median copayment in 2019 is $40; the median coinsurance rate is 20 percent.

- Eight of the 10 largest PDPs charge copayments for preferred brands, varying from $25 (AARP MedicareRx Saver Plus) to $47 (Aetna Medicare Rx Value Plus and Humana Enhanced).

- In 2019, virtually all PDPs are using coinsurance for the non-preferred drug tier. The median coinsurance PDPs charge for non-preferred drugs is 40 percent.

- Among the top 10 PDPs, coinsurance for non-preferred drugs varies in 2019 from 32 percent (AARP MedicareRx Walgreens) to 50 percent (Humana Enhanced), the maximum allowed for this tier by CMS guidelines (which is higher than the maximum coinsurance allowed for specialty drugs).

- In 2019, the threshold for drugs to qualify for placement on a specialty tier is $670 for a one-month supply of the drug, the same as in 2017 and 2018. For all PDPs, the specialty tier coinsurance ranges from 25 percent to 33 percent, the maximum allowed by CMS guidelines; most PDPs charge either 25 percent or 33 percent.

- Five of the top 10 PDPs use 25 percent coinsurance for their specialty tiers, the maximum allowed for plans with a standard deductible; four of the top 10 PDPs charge 33 percent.

Low-income Subsidy (Benchmark) Plans

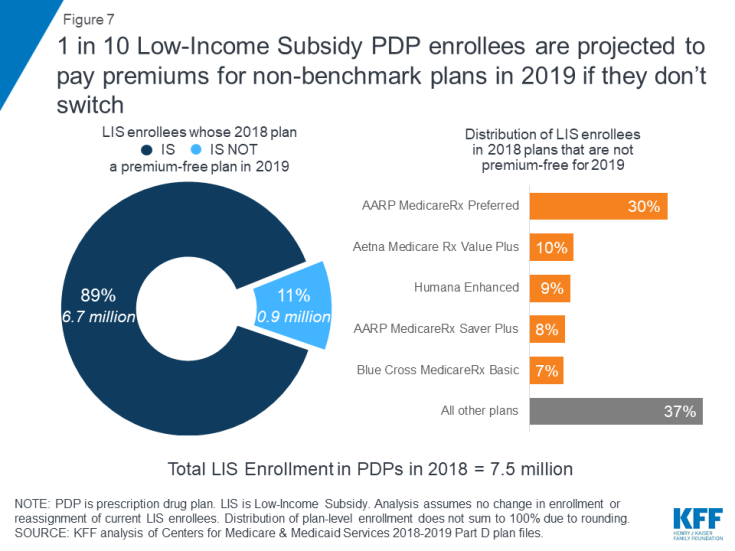

In 2019, 215 plans will be premium-free benchmark plans—that is, PDPs available for no monthly premium to beneficiaries receiving the Low-Income Subsidy (LIS). This total is one less than in 2018 and the lowest number of benchmark plans since Part D started in 2006 (Figure 6, Table 1).

Figure 6: In 2019, a total of 215 Part D stand-alone prescription drug plans will be available without a premium to enrollees receiving the Low-Income Subsidy (“benchmark” plans)

- On average (weighted by enrollment), LIS beneficiaries have six benchmark plans available to them for 2019, or about one-fifth the average number of PDP choices available overall. All LIS enrollees can select any plan offered in their area, but if they enroll in a non-benchmark plan, they must pay some portion of their chosen plan’s monthly premium.

- Of the 215 benchmark plans in 2019, 29 plans qualify through the “de minimis” policy—more than the 14 de minimis plans in 2018. The de minimis policy makes it easier for plans to qualify as benchmark plans and retain their current LIS enrollees by allowing them to waive a premium amount of up to $2 above the regional LIS benchmark. Although benchmark plans that qualify through the de minimis policy can keep their existing LIS enrollees, they cannot receive auto-assigned enrollees.

Benchmark Plans by Region

- The number of benchmark plans available in 2019 will vary by region, from just two benchmark PDPs in Florida (out of 27 PDPs overall) to 10 benchmark PDPs in Arizona (out of 28 PDPs) (see map; Table 1).

- Benchmark plan availability will be unchanged in 22 of 34 regions between 2018 and 2019. Seven regions will experience a decline of one or two benchmark plans, while five regions will experience an increase of one or two benchmark plans.

- In 2019, three-quarters of LIS PDP enrollees are projected to be in PDPs operated by four plan sponsors: CVS Health/SilverScript, Humana, UnitedHealth, and Aetna. All four sponsors offer PDPs that qualify as benchmark plans in at least 28 of the 34 PDP regions in 2019.

–

Impact of Benchmark Plan Changes for Low-Income Subsidy Enrollees

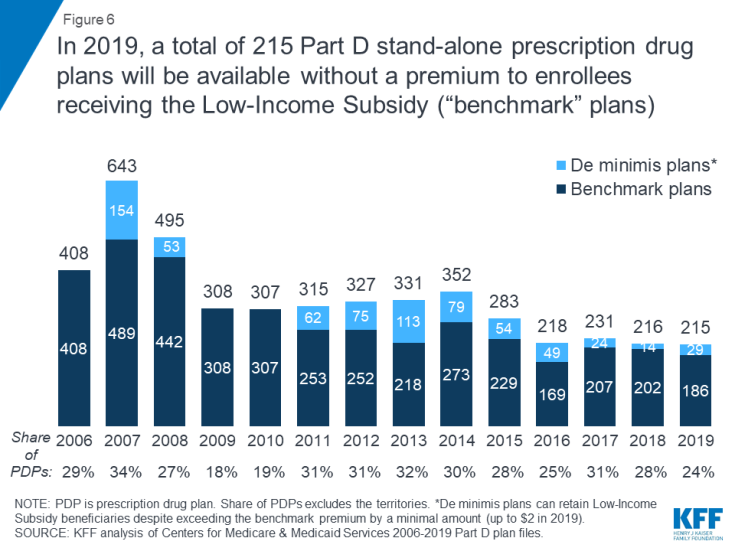

- Nearly one million LIS beneficiaries—just over one in 10 LIS enrollees in PDPs (11%)—are enrolled in PDPs in 2018 that will not qualify as benchmark plans in 2019 (Figure 7). CMS will reassign these LIS beneficiaries to another plan if they were randomly assigned to their current plan, but those who have chosen their current plan must switch on their own to avoid paying a premium if they remain in their 2018 plan.

- These nearly one million LIS beneficiaries face monthly PDP premiums that average almost $28 ($333 per year) if they were to remain in their current plan for 2019. More than 250,000 of these LIS beneficiaries are enrolled in the AARP MedicareRx Preferred PDP, and they will pay a monthly premium of more than $41, on average, if they stay in this PDP for 2019.

Discussion

Our analysis of the Medicare Part D stand-alone drug plan landscape for 2019 shows an increase in plan availability for 2019, along with a modest increase in the average monthly PDP premium. Medicare beneficiaries face more than two dozen PDP choices during this year’s open enrollment period. Some Part D enrollees who choose to stay in their current plans may see lower premiums and lower cost sharing for their drugs, but others will face higher premiums, deductibles, and cost sharing if they remain in their current plans. As in prior years, all Part D enrollees could benefit from the opportunity to compare plans during open enrollment, since plans vary in numerous ways that can have a significant effect on an enrollee’s out-of-pocket spending.

Juliette Cubanski and Tricia Neuman are with the Kaiser Family Foundation.

Anthony Damico is an independent consultant.

|

Methods This analysis focuses on the Medicare Part D stand-alone prescription drug plan marketplace in 2019 and trends over time. The analysis includes 20.6 million enrollees in stand-alone PDPs. The analysis excludes 16.0 million MA-PD enrollees (non-employer), and another 4.5 million enrollees in employer-group only PDPs and 2.3 million in employer-group only MA-PDs for whom plan premium and benefits data are unavailable. Data on Part D plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS) on a regular basis:

|